Inventory Turnover Rate Analysis & Management Adjustment for Dupbuy Purchasing Service in Spreadsheets

2025-04-25

1. Calculating Inventory Turnover Rate in Spreadsheets

The inventory turnover rate measures how efficiently Dupbuy's purchasing service manages stock. In spreadsheets (e.g., Google Sheets or Excel), use:

- Formula:=COGS / Average_Inventory

- COGS (Cost of Goods Sold):=Beginning_Inventory + Purchases - Ending_Inventory

- Average Inventory:=(Beginning_Inventory + Ending_Inventory) / 2

Example Implementation:

| Metric | Cell | Formula |

|---|---|---|

| COGS | B5 | =B2+B3-B4 |

| Average Inventory | B6 | =(B2+B4)/2 |

| Turnover Rate | B7 | =B5/B6 |

2. Analyzing Relationships Between Data Metrics

The calculated turnover rate interacts critically with other business data:

A. Sales Data Correlation:

- Declining turnover + stable/high sales → Potential overstocking.

- Rising turnover + strong sales → Healthy stock velocity.

B. Procurement Data Impact:

- High turnover + frequent low-quantity purchases → Optimize bulk ordering.

- Low turnover + large purchases → Adjust order volumes.

Visualize trends via time-series charts comparing turnover rate with % changes in sales/purchasing.

3. Strategy Adjustments Based on Turnover Trends

Scenario 1: High Turnover Rate (Fast-Moving Goods)

Actions:

- Prioritize these items in procurement planning.

- Negotiate bulk discounts with suppliers.

- Lower safety stock levels to free up capital.

- Use marketing to further boost sales (bundling/upselling).

Scenario 2: Low Turnover Rate (Slow/Shelf Items)

Actions:

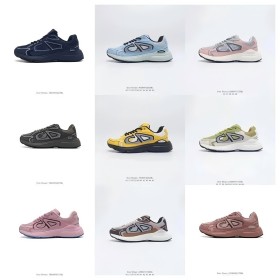

- Flag underperforming SKUs for clearance (flash sales/promotions).

- Reduce/stop future purchases until stock normalizes.

- Analyze causes (pricing? demand shifts?) and reposition.

Intermediate Strategies:=IF(B7>4,"Fast","Slow")

Conclusion: Maximizing Efficiency

By automating turnover calculations and coupling them with procurement/sales dashboards, Dupbuy can dynamically:

- Identify stagnation risks 20-30% earlier via real-time alerts.

- Allocate working capital to high-turnover inventory.

- Adjust supplier terms based on category velocity.

Implement conditional formatting in spreadsheets to highlight priority areas (e.g., red for turnover <1x/year, green for >6x/year).